Rated #1 Home Insurance (Seedly, Oct 2021)

Simple and affordable home protection. Designed for Singapore residents who appreciate fuss-free protection for the home that you’re working hard for. We understand your belongings are more than just possessions. That’s why we’re here to make things right when accidents happen at home.

Why Tiq Home Insurance?

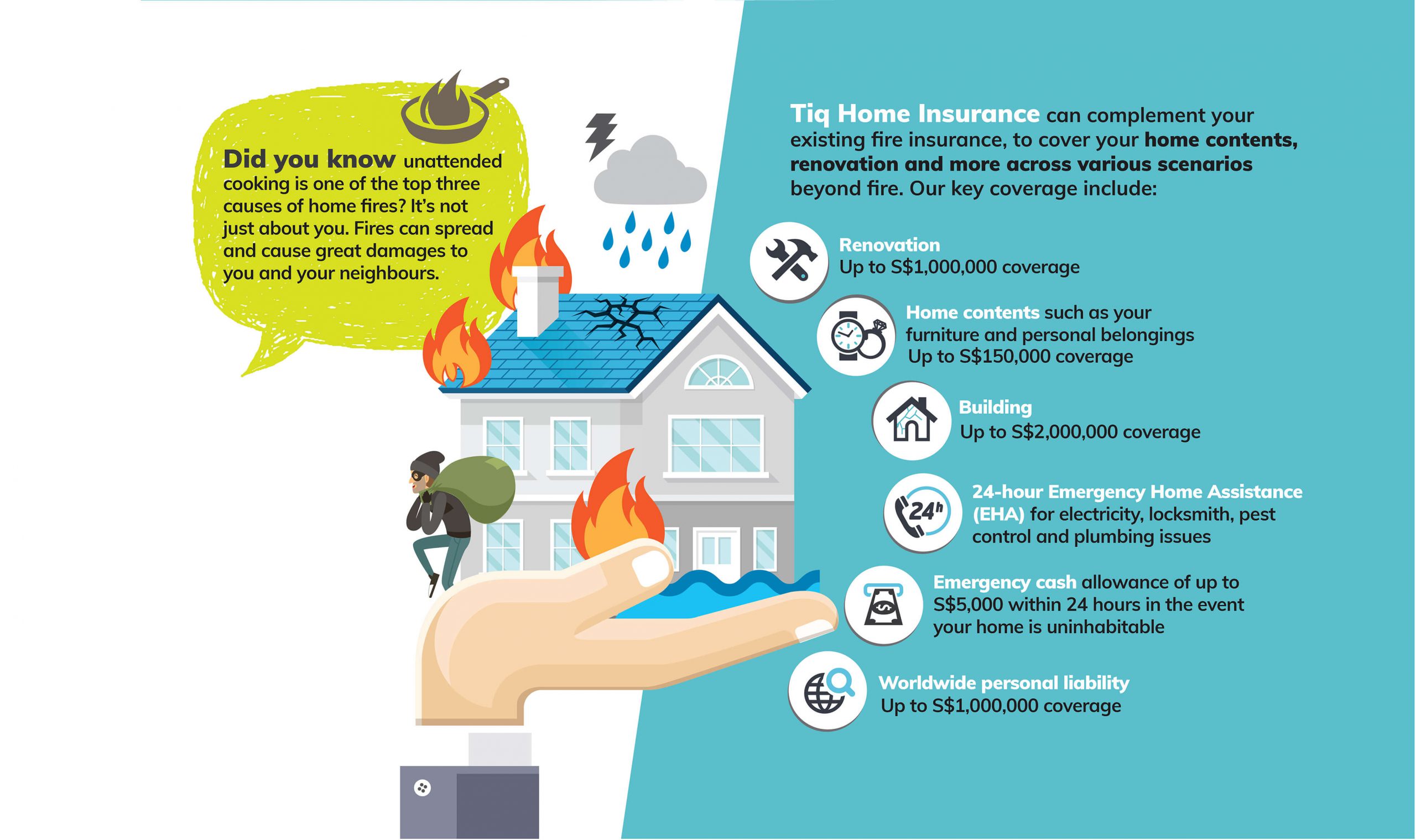

Most fire insurance offer only basic protection for the structure, permanent fixtures and fittings of your home in the event of fire. But your renovation and personal belongings matter too!

Tiq Home Insurance at a glance

Choose from 1, 3 or 5 years’ plan. Save more with longer protection!

| BENEFITS | HOMEOWNER / LANDLORD | TENANT | |

| HDB | CONDOMINIUM / LANDED | ||

| Building* | $29,000 - $106,200 | $300,000 - $2,000,000 | Not available |

| Renovation* | $20,000 - $180,000 | $100,000 - $1,000,000 | Not available |

| Contents* | $15,000 - $120,000 | $50,000 - $150,000 | $15,000 - $120,000 |

| Emergency Cash Allowance * ENHANCE Allows you to do the following:

|

100% Uninhabitable: $5,000 = 50% Uninhabitable: $2,500 |

100% Uninhabitable: $500 = 50% Uninhabitable: $250 |

|

| Emergency Home Assistance (applicable for plans of 3 years or more) | $200 and up to 4 times per year | ||

| Personal Legal Liability (Worldwide) | $500,000 | $1,000,000 | $500,000 |

| Valuables | 30% of Content Sum Insured | ||

| Removal of Debris | 10% of Renovation Sum Insured | Not Available | |

| Professional Fees ENHANCE | 10% of Building and/or Renovation Sum Insured | ||

| Conservancy Charge | $500 | ||

| Unauthorised transactions on your stolen ATM or credit card | $1000 | ||

| Accidental Breakage of Mirrors and Fixed Glass NEW | $1,000 | Not available | |

| Money NEW | $750 | ||

| Personal Cyber Insurance

Covers you from: • Cyber Fraud • Cyber Extortion • Restoration Costs • Identity Theft |

$25,000 | $25,000 | |

| Family Accidental Death Protection (Only applicable for age 70 year old and below) | $50,000 | Not Available | |

Stay safe online with protection beyond your home

Have you locked your door? While most of us are mindful of our main door at home, it is easy to overlook our virtual door(s). This makes you vulnerable to cyber risks, especially if you are a multi-device user. Get safety in connectivity with comprehensive protection for data breach, privacy invasion and assets loss due to cyber-attacks. While taking due diligence for cyber security is essential, you can get better peace of mind with Tiq’s online risk solution.

|

|

|

||||||

|

|

|

|||

|

|||

|

|||

|

|||

|

Let Hossan Leong show you how 24/7

Emergency Home Assistance works

Insured but still looking?

Let us know when your policy ends and we’ll send you a reminder to switch to Tiq by Etiqa Insurance.

Set. Relax. No Regrets!

Don’t worry, we’ll wait for you!

Disclaimer: We will not be held responsible if our reminder doesn’t reach you and you choose to cancel your policy with your existing insurer.

Submit Failed.

Thank you for your submission.

Frequently Asked Questions

Yes. HDB Fire Insurance only covers the structure of your home in the original state it was built. Tiq Home Insurance will provide comprehensive coverage for your home contents, renovation and belongings

Only 3 simple things!

1. Your residence status (homeowner or tenant, living in or renting)

2. Your residence type (HDB, Condo, Landed)

3. Number of Bedrooms

It is for homeowners or tenants of HDB, Condominium or Landed property who want to protect your building, renovation and home contents.

Featured Articles

4 Reasons Why Home Insurance Is Not a Waste of Money

Is Home Insurance The Same As HDB Fire Insurance?

Real Life Situations Where Home Insurance Comes In Handy

See What Our Customers Say

Important notes:

This policy is underwritten by Etiqa Insurance Pte. Ltd. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract. This policy is protected under the Policy Owners’ Protection Scheme administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the GIA/LIA or SDIC web-sites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg). Information is accurate as at 16 April 2024.

Be the first to know

Get the latest promotions and news

I consent and agree for Etiqa Insurance to collect, use and disclose the personal data above for the purposes of validation and sending, via telephone calls and text message. Read Etiqa's Privacy Policy [here]

Subscription Successfully.

Subscription Failed.