Essential Cancer Care

Get a peace of mind with all stages of cancer covered.

Essential Cancer Care 15% off First Year Premium

To help you to safeguard your future and your loved ones, Etiqa is offering 15% off first-year premium* for Essential Cancer Care which provides affordable protection for all stages of cancer.

From as low as S$1.01 per day1, get protected against early, intermediate and severe stages of cancer for up to S$250,000.

Policy type

Term life plan

Policy term

- 5 years (renewable)

- 10 years (renewable)

- 20 years

- Until 65 years old

Premium term

Regular premium throughout policy term

What you can get

Covers all stages of cancer

Additional monthly payout for severe cancer

Guaranteed renewability

Lump sum payout upon death

Notes

1Premium is illustrated based on a 5-year renewable term plan for a male aged 17 years, non-smoker and a sum insured of S$250,000 after 15% premium discount in the first policy year based on yearly premium frequency.

2Please refer to the policy provisions for full details of the terms and conditions.

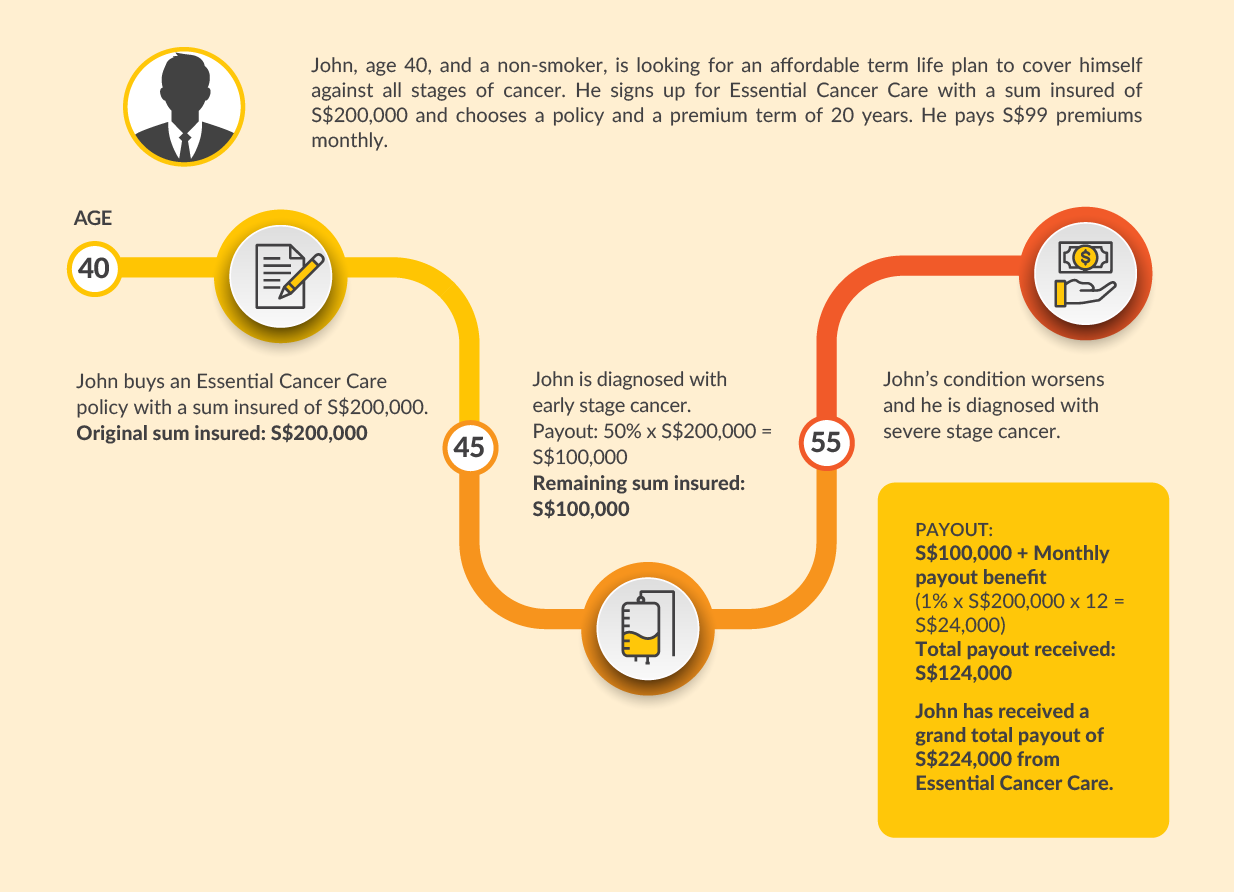

Here’s how Essential Cancer Care works

Download Brochures

*Terms & Conditions

- This Essential Cancer Care First Year 15% Premium Discount (“Promotion”) is applicable to policies signed from 1 July 2025.

- Customers who purchase Essential Cancer Care via a representative during the Promotion Period are entitled to a 15% premium discount off their first-year premium (“Premium Discount”).

- The Premium Discount will be automatically applied during the application process.

- Existing terms and conditions for Essential Cancer Care apply.

- This Promotion is not valid in conjunction with any ongoing or existing insurance promotions, coupons, staff discounts and privileges, unless otherwise stated.

- Etiqa reserves the right to amend these terms and conditions at any time at our sole discretion, including changing the terms or terminating the Promotion at any point in time before the stated Promotion Period without prior notice, by posting such amendment(s) to etiqa.com.sg.

Age means the age at the next birthday.

This policy is underwritten by Etiqa Insurance Pte. Ltd.. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

As this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information on this page is correct as of 1 January 2024.

You might also be interested in