Enrich rewards

Product type

Policy term

Premium term

3 years1

What you can get

Guaranteed yearly payouts

Choose to receive cash yearly from the third policy year, or reinvest the cash for potentially higher returns.

100% capital guaranteed

Your capital is fully guaranteed at the end of 10 years.

Short payment term

Death coverage

No health check-up

Start immediately on your savings journey hassle-free, with no health checks required.

Notes

1Automatic Premium Benefit (APB) will pay the premiums of the policy from the 4th policy year onwards after the full premium for the first 3 years has been received. Please refer to the policy contract for full details of the terms and conditions.

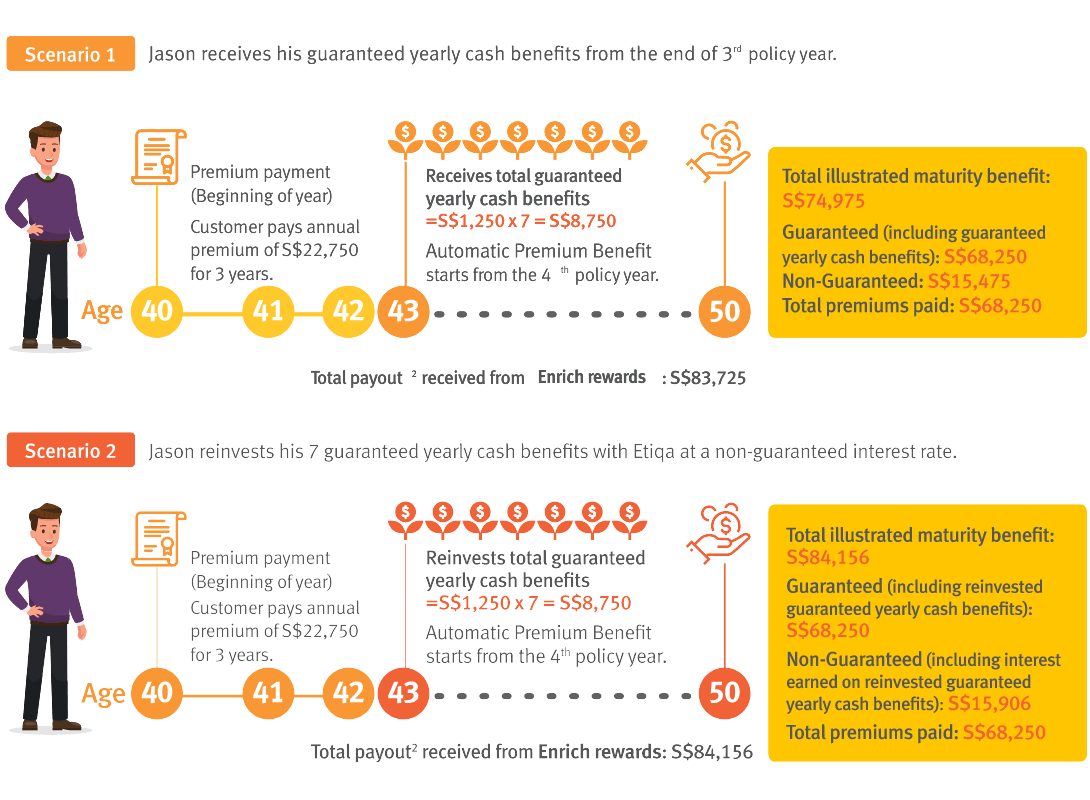

Here's how Enrich rewards works

The scenario(s) above are for illustration purposes only.

2The above illustrated values use bonus rates assuming an illustrated investment rate of return of 3.35% per annum. Assuming an illustrated investment rate of return of 2.10% per annum, the total payout received from Enrich rewards under Scenario 1 and Scenario 2 are S$72,637 and S$72,637 respectively. The two rates, 3.35% per annum and 2.10% per annum, are used purely for illustrative purposes and do not represent the upper and lower limits on the investment performance of the participating fund. As the bonus rates are not guaranteed, the actual benefits payable will vary according to the future performance of the participating fund. Past performance or any forecasts are not necessarily indicative of the future or likely performance of your participating policy.

Download Brochures

Age means the age at next birthday.

This policy is underwritten by Etiqa Insurance Pte. Ltd.. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 29 September 2023.

You might also be interested in