Exclusively for Maybank XL Cardmembers, bringing you added peace of mind on your travels. Enjoy free overseas medical expenses coverage, ensuring you’re protected wherever your journey takes you. Travel smarter and safer—on us.

What does Trip XpLorer Protect Cover?

Up to S$5,000 coverage for overseas medical expenses

- Applicable for accidental injuries and illness during leisure trips only

- Includes coverage for Adventurous Activities such as hiking, bungee jumping and skydiving

Note: Overseas medical expenses must be paid using an eligible Maybank XL Cashback Card or Maybank XL Rewards Card to be eligible for reimbursement under this insurance benefit. For full details on coverage, benefits, and exclusions, please refer to the Certificate of Insurance.

How to Get Your Free Coverage

- Apply for a Maybank XL Cashback Card and/or Maybank XL Rewards Card to be eligible for this cover. Please note that you must be between 21 and 39 years old to be eligible for this benefit.

- Your coverage will be activated once your card has been approved.

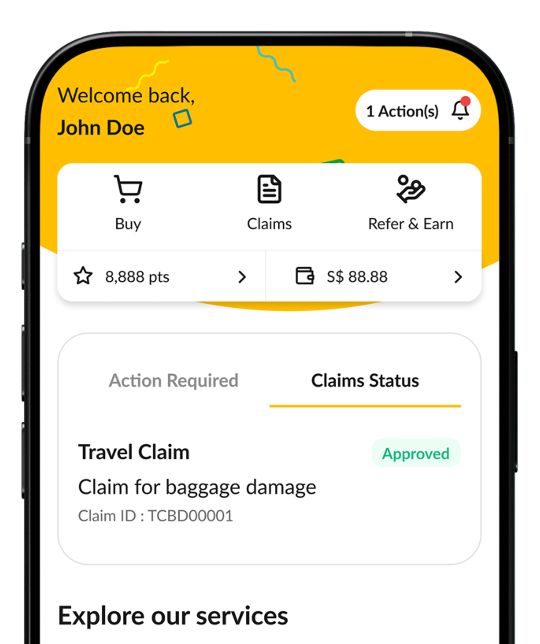

- Receive an email confirmation from us within 3 working days and login to our customer portal, TiqConnect

Looking for more comprehensive travel protection? Upgrade to Tiq Travel Insurance for enhanced coverage and added peace of mind. Enjoy higher limits and additional benefits such as local medical expense coverage, travel delay compensation, trip cancellation protection, and more.

Your Claim, Made Easy

What do I need to prepare?

Please have the following documents ready:

- Boarding pass or passport with immigration stamp

- Original receipts from the clinic or hospital

- Credit card statement showing the medical bill payment

- For dental claims due to an accident, a memo certifying the cause of treatment is required

Where do I submit my claim?

You can submit your claim by downloading the claim form from our customer portal, TiqConnect, and emailing it to travelclaims@etiqa.com.sg. For first-time users of TiqConnect, please register an account using your Singpass login. Once logged in:

- Click on “My Policy”.

- Select “Trip XpLorer Protect” from the list.

- Click on “Manage Policy”.

- Download the claim form.

- Complete the claim form and email it to travelclaims@etiqa.com.sg along with the required documents

What happens next?

After you’ve successfully submitted your claim, you will receive an email notification from us. Our claims team will review and assess your submission, and you can expect to hear back within two weeks.

Frequently Asked Questions (FAQs)

Trip XpLorer Protect provides coverage of up to S$5,000 for overseas medical expenses resulting from adventurous and leisure activities, including accidental injury and illness. For full coverage details and exclusions, please refer to the policy wording.

Your coverage begins once your Maybank card has been approved. You will receive a welcome email from Etiqa with your policy details and confirmation of coverage.

Your coverage ends one year from the date your first XL card is approved by Maybank, or upon card termination, whichever comes first. You can check your coverage period by logging in to our Customer Portal, TiqConnect, and viewing the policy details.

You can view your certificate of insurance by logging in to our Customer Portal, TiqConnect, and navigating to the “Policy Details” section.

Yes, all overseas medical expenses must be paid using your Maybank XL Credit Card in order to qualify for a claim. Claims made using other payment methods will not be eligible.

To make a claim, login to our customer portal, TiqConnect to download the claim form and email your claim along with the necessary supporting documents to travelclaims@etiqa.com.sg. For further assistance, you can also contact Etiqa’s customer service.

No, having multiple Maybank XL cards does not entitle you to multiple sums insured. Coverage is limited to one policy per cardholder.

Terms and conditions apply.

These policies are underwritten by Etiqa Insurance Pte. Ltd. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions and be found in the policy contract.

Trip XpLorer Protect and Tiq Travel Insurance is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg or www.sdic.org.sg).

Information is accurate as at 29 July 2025.

You might also be interested in