Rising inflation, higher interest rates and global uncertainty about jobs… People around the world are stressing over money, and this is especially true for Singaporeans. Last year, the rising cost of living and the looming economic recession were key points of concern for Singaporeans. Just for your reference, our lion city tied with New York for being the most expensive city to live, in a survey by the Economist Intelligence Unit.

While moderate stress (in the short-term) can inspire and motivate people to enhance performance, prolonged unhealthy stress can wear you out and affect your health. So let’s see how we can better manage financial stress.

Why are you stressing over money?

To eliminate or solve a problem, it is important to go to the root of the issue. Hence, before you try to stop stressing over money, let’s explore the root cause of your financial stress.

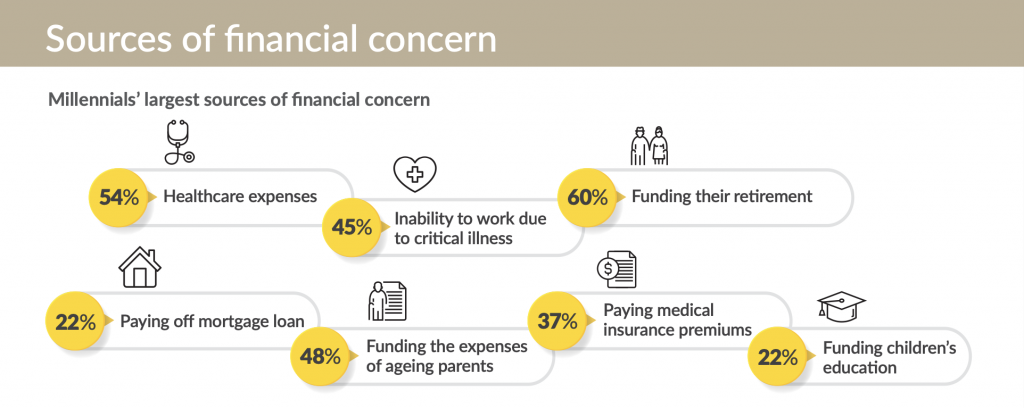

Based on Etiqa’s Protection Survey Report, millennials worry most about funding their retirement, expenses of ageing parents and healthcare expenses amongst other financial concerns. Let’s look at the factors that contribute to these concerns.

Top drivers of stress in Singapore

- High cost of living

Singapore has one of the highest costs of living in the world, with high housing costs, transportation costs, and healthcare costs all contributing to one’s financial burden. According to Singstat, the average monthly expense for each household member is about S$2,000. All of us have been feeling the impact on rising prices, particularly in food and energy costs. Unfortunately, it seems inflation is expected to remain high in 2023.

How to cope? While there’s nothing much we can do about the rising prices, we can be more prudent in spending and smarter in managing our money. The first step to improving one’s finances starts with proper budgeting. Once you are able to manage your money well, you will naturally worry less.

To make the most of your money, you may also consider endowment plans that help you to accumulate savings while providing life protection or start investing. Also, always keep a lookout for opportunities to advance your career and improve your financial situation.

- Uncertainty about the future

Besides the high cost of living in Singapore, the competitive job market can make it challenging for people to secure stable, well-paying jobs and build a sustainable financial future. To add on to the stress, adult workers in Singapore must adapt to the rapid pace of technological change and globalisation, as many traditional jobs are being replaced by new, highly-skilled positions.

Faced with declining real wages and increasing debt levels, the challenge of saving for retirement seems bigger than ever in our rapidly ageing population. In fact, millennials revealed that they worry most about funding their retirement.

Yet, a survey conducted by Booking.com last year found that 59% of Singaporeans would choose travel over a work promotion. This reflects the demanding work culture in Singapore, which can lead to high levels of stress and burnout.

How to cope? If you too are feeling uncertain about the future, you may consider planning ahead. Being prepared for whatever that’s stressing you can help you to feel better, and aid you in solving the issue and possibly turning it into an opportunity. Before you start worrying about how difficult this seems, here’s a tip: you can reduce stress by eliminating negative self-talk.

Upskilling and reskilling are two ways to secure and make progress in your career. For those who worry most about losing your income due to health concerns, unfortunately, it is true that critical illness can happen to anyone at any time. Nonetheless, you can reduce the risks by taking good care of your health and ensuring you have adequate financial protection.

The fact that you are reading this article shows that you are finding positive ways to cope with your stress, and be prepared for the unknown. Here’s a piece of good news to add on to your positivity: Remember we mentioned Singtel Bill Protect – a complimentary personal accident plan that provides coverage against accidental death and retrenchment benefits? Well, you can get some financial relief on unpaid Singtel bills in the event of retrenchment if you are an eligible Singtel Postpaid Personal Mobile Subscriber. This will help to ease some financial concerns and allow one to better focus on job search. Terms and conditions apply, learn more at https://www.etiqa.com.sg/singtelpartnership.

- Family finance

Based on Etiqa’s protection survey report, millennials worry most about their parents’ healthcare and living expenses. Some of us are part of the sandwich generation, meaning we are caring for both our ageing parents and our children.

It can be tough trying to balance the demands of caring for elderly parents with the responsibilities of raising children. As a result of supporting multiple generations, one is likely to experience financial strain.

How to cope? It is important to plan for life’s many milestones such as our parents’ retirement and when they need support. Discuss with your loved ones on how you can share responsibilities (e.g. supporting your parents together with your siblings), and prioritise saving and investment goals.

It is also important to factor the financial needs of your parents in your life insurance coverage if they are under-insured1. Doing so will ensure your loved ones’ lives can go on, regardless of any unforeseen tragedy.

Did you know that choosing the right telco can help you to save while getting complimentary protection? If you are a Singtel Postpaid Personal Mobile Subscriber, you may be eligible for Singtel Bill Protect – a personal accident plan that provides coverage against accidental death and retrenchment benefits2. Accidents can happen anytime, and this complimentary plan adds a layer of assurance and financial security for our loved ones.

- Personal finance

Putting aside avocado toast and lattes, some millennials and Gen Z in Singapore are used to certain lifestyle comforts. Trying to maintain a certain standard of living could put a dent on one’s personal finances, leading to financial stress and anxiety.

It all boils down to making decisions, but some are more challenging and complex than the others; i.e. choosing investments, buying insurance and planning for retirement. This can be extra stressful if you are not confident in your abilities to make informed decisions.

How to cope? There are many resources available to help individuals manage their finances and reduce financial stress in Singapore, including financial advisors, government programs, and online resources. Based on our understanding, Gen Z and millennials are looking for accessible and easily digestible financial advice and protection.

While financial influencers can provide valuable information and insights on personal finance, it is important to remember that everyone’s financial situation is unique and what works for one person may not work for another. It is always best to consult with a financial advisor and do your research thoroughly before making any financial decisions.

How to reduce financial stress?

Stressing over money can be overwhelming and impact many aspects of your life. Apart from the abovementioned: you may want to consider the following ways to help you worry less about money.

Communicate with your partner: If you have a partner, it’s important to have open and honest conversations about your finances. This can help you both understand each other’s financial goals and support each other during financial stress.

Prioritise your spending: Make a budget and focus on spending your money on the things that are most important to you.

Create an emergency fund: Having an emergency fund can help you feel more secure and reduce worry about unexpected expenses. Having a personal accident plan such as Singtel Bill Protect in place can provide peace of mind against life’s uncertainties, such as retrenchment or accidental death.

Reduce debt: High levels of debt can be a major source of financial stress. Focus on paying off your debts, starting with the ones with the highest interest rates.

Live within your means: Don’t spend more than you earn and avoid taking on additional debt. For those who wish to save but lack the financial discipline, you can consider getting an endowment plan.

Seek professional advice: If your financial worries are overwhelming, consider seeking the help of a financial advisor or therapist. They can help you develop a plan to manage your finances and provide support during the process.

Lastly, bear in mind that it is normal to worry about money, but you can reduce stress and live a happier life by prioritising self-care and taking steps to improve your financial situation.

[End]

Information is accurate as at 7th June 2023. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

1As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

2It is usually detrimental to replace an existing accident and health plan with a new one. A penalty may be imposed for early plan termination and the new plan may cost more, or have less benefits at the same cost.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Group

Group