Invest builder

Receive an exclusive additional 5% Bonus Top-up on 1st year premium* for all eligible sign-ups by 30 September 2025.

*Please refer to the full T&Cs here.

Product type

Policy term

To age 100

Premium term

3, 5, 10 to 20 years

What you can get

Receive multiple bonuses to boost your investment

- Start-up bonus1 of up to 64% of your annual premium in the first 2 policy years

- A loyalty bonus1 of 2.0% p.a. of account value from policy year 11 onwards

- Additional bonus1 of 0.1% p.a. of account value from policy year 6 to 10

Flexibilities in times of uncertainties

When a covered life contingency event occurs, you can choose to:

- Make partial withdrawals at no charge1, or

- Take a break from paying premiums1

Access to exclusive reputable funds

No health check-up

You can start immediately on your investment journey, with no health check required for the basic plan.

Switch funds at no charge

Death coverage

Give your loved ones peace of mind should the unexpected happen. They will receive a lump sum payout equivalent to the higher of 105% of net premiums4 or account value, less any outstanding amounts in the event of death.

Enhance your protection with this add-on

Extra secure waiver rider

Notes

1Subject to applicable terms and conditions. Please refer to policy contract for terms and conditions.

2Based on the minimum regular premium amount for a premium payment term of 20 years.

3We reserve the right to revise the fund switch charges (if applicable) by giving thirty (30) days’ written notice.

4Net premium refers to total premium paid plus total top-up(s) less any partial withdrawal(s).

Etiqa’s Portfolio Funds and ILP Sub-Funds

We understand that everyone has a different approach to investing. We tailor your investment plan by matching your risk level and financial goals with these Portfolio funds, and a mixture of different ILP sub-funds.

Portfolio Funds

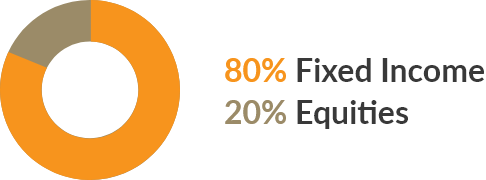

Conservative

Low Risk

Friendly for:

- Low risk taker

- Looking for stable returns

- Tolerance for low volatility

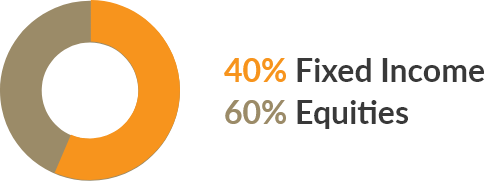

Moderate

Medium Risk

Friendly for:

- Medium risk taker

- Looking for moderate returns

- Tolerance for some unpredictable fluctuations

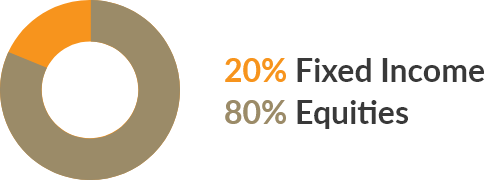

Growth

High Risk

Friendly for:

- High risk taker

- Looking for capital growth

- Tolerance for sharp fluctuations

Aggressive

High Risk

Friendly for:

- Higher risk taker

- Looking for maximum long term growth

- High tolerance for fluctuations

ILP Sub-Funds

- Alliance Bernstein American Income Portfolio Fund

- Abrdn All China Sustainable Equity Fund

- Abrdn Global Dynamic Dividend Fund

- Allianz Income and Growth Fund

- Baillie Gifford Worldwide Asia ex Japan Fund

- Baillie Gifford Worldwide Health Innovation Fund

- Baillie Gifford Worldwide Long Term Global Growth Fund

- BlackRock Global Funds (“BGF”) ESG Global Bond Income Fund

- BlackRock Global Funds (“BGF”) European Equity Income Fund

- BlackRock Global Funds (“BGF”) ESG Multi-Asset Fund

- BlackRock Global Funds (“BGF”) World Technology Fund

- Capital Group American Balanced Fund

- Eastspring Japan Dynamic Fund

- Finexis Millenium Equity Fund

- First Sentier Bridge Fund

- FSSA Dividend Advantage Fund

- FSSA Regional China Fund

- Fullerton Asia Absolute Alpha Fund

- Fullerton SGD Income Fund

- Fundsmith Equity Fund

- LionGlobal Infinity Global Stock Index Fund

- LionGlobal Singapore Dividend Equity Fund

- LionGlobal Singapore Trust Fund

- Maybank Asian Equity Fund

- Maybank Asian Growth and Income Fund

- Maybank Asian Growth and Income-I

- Maybank Asian Growth and Income (DIST)

- Maybank Asian Growth and Income-I (DIST)

- Maybank Asian Income Fund

- MAMG Global Sukuk Income-I

- Nikko AM ARK Disruptive Innovation Fund

- Pictet Premium Brands Fund

- PIMCO Income Fund

- PineBridge International Funds – Singapore Bond Fund

- SCHRODER AS COMMODITY A ACC SGD-H

- United Global Healthcare Fund

- United SGD Money Market Fund

- United Singapore Bond Fund

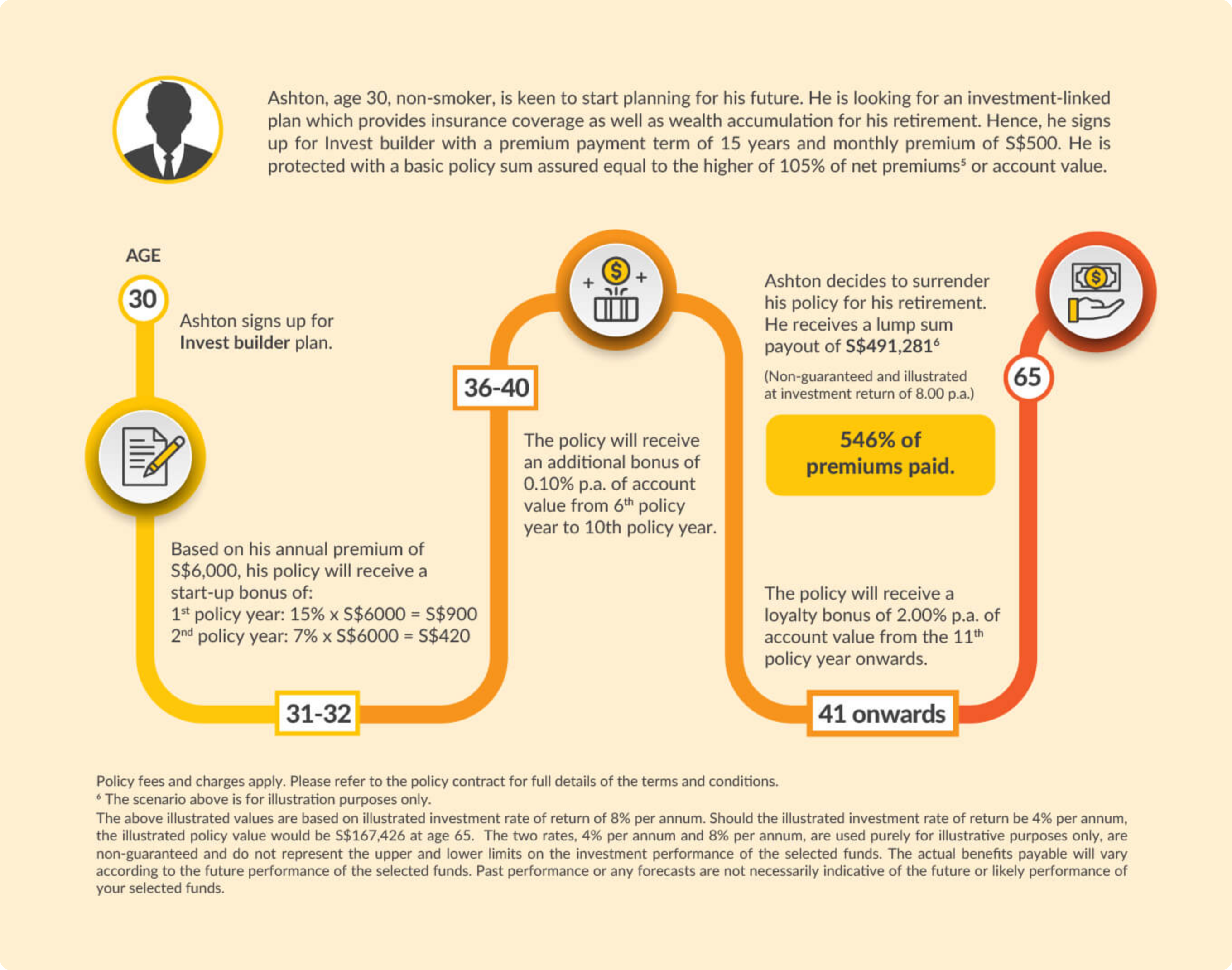

Here's how Invest builder works

Download Brochures

- This promotion is only applicable for policies signed between 1 July 2025 and 30 September 2025 and issued by 31 October 2025.

- Eligible sign-ups will be entitled to an additional 5% start-up bonus on the regular premium paid in the first policy year and this applies to all premium amounts and premium payment terms.

- This promotion is applicable for all premium payment terms and payment mode selection.

- Policies that are not taken up or cancelled during the free look period shall not qualify for this promotion. Any start-up bonus which was paid to customer(s) will be clawed back.

- Etiqa shall not be liable to any applicant or any party, whether in contract or tort (including negligence) or otherwise, for any liabilities, losses and damages, claims, costs and expenses or for any special or consequential damages or losses in connection with, related to or resulting from this promotion.

- Etiqa reserves the right to change the terms and conditions of this promotion without prior notice.

- All decisions made by Etiqa on this promotion shall be final and binding on all persons.

Age means the age at next birthday.

This policy is underwritten by Etiqa Insurance Pte. Ltd.. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

Invest builder is an Investment-linked Plan (ILP) which invests in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s).

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from us via https://www.etiqa.com.sg/portfolio-funds-and-ilp-sub-funds. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 2 May 2024.

You might also be interested in

Let us help you

Group

Group