Life & Critical Illness Protection

Life can take unexpected turns. Do you have a backup plan to provide for your next-of-kins should you lose your regular income due to illness or death?

Choose from our affordable Life & Critical Illness protection plans and put aside undue worries about your future finances.

Your current priority is

Frequently Asked Questions

Yes, if you fulfil the following requirements:

- You are a Singapore resident with valid NRIC or FIN.

- You are between the age of 19 and 65 years old.

- You are a tax resident of Singapore.

- You have resided in Singapore for 182 consecutive days on day of insurance purchase.

- You are proficient in spoken or written English.

- You are not an undischarged bankrupt.

- You are not purchasing this plan to replace any existing policy with Etiqa or other insurer(s).

Direct Purchase Insurance (DPI) – identified by the prefix “DIRECT” in their product names – are life insurance products that you can buy directly from insurance companies, without paying any intermediary fee.

Etiqa provides two DPI options, namely DIRECT – Etiqa term life II & DIRECT – Etiqa whole life. Both options come with Life and Total and Permanent Disability cover and an option to cover Critical Illnesses. More information on DPI is available at: DPI Fact Sheet or MoneySense website.

You can insure yourself from S$50,000 up to S$400,000 for DIRECT – Etiqa term life II or up to S$200,000 for DIRECT – Etiqa whole life.

You may consider our ePROTECT term life policy, which can provide coverage up till S$2 million.

Yes, you will be covered as long as you continue paying your premiums.

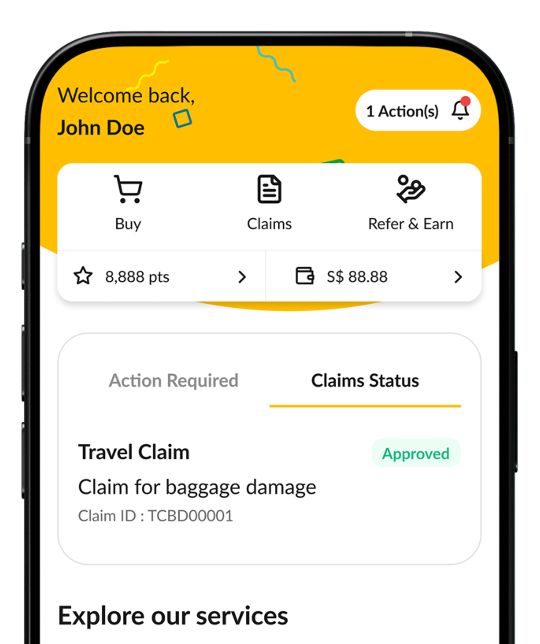

The easiest way to get life insurance from Etiqa is through our online portal.

You can also contact our friendly Customer Care team.

You might also be interested in