Essential term life cover

Absolutely Low Premium Rates & Up to 47%* Perpetual Discount

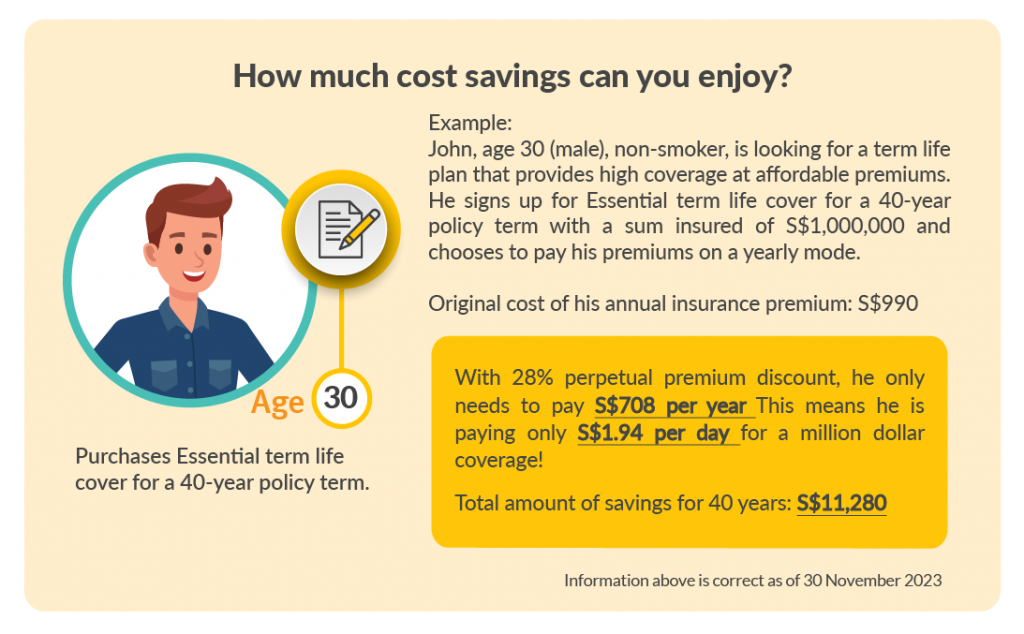

What can you buy with 60 cents? With Etiqa, just S$0.60 per day** gets you a million dollar coverage against death or terminal illness throughout the policy term!

*T&Cs apply. Discount varies according to age, gender, smoking status, sum insured and policy term.

**Premium is based on 17 years old female, non-smoker for a 10-year policy term and sum insured of 1 million after discount for Essential term life cover. Age means the age at next birthday.

Policy type

Term life plan

Policy term

- 5 years (renewable)

- 10 years – Until age 86

(every one year interval) - Until 100 years old

Premium term

Regular payment throughout policy term

What you can get

High coverage, affordable premiums

Enjoy more for less. With affordable premiums, receive payouts starting from $401,000 in the event of death or terminal illness during your policy term.

Guaranteed renewability

Flexibility to convert policy

Need higher coverage? No problem

Enhance your protection with these add-ons

Early CI rider

Get advanced payout for death benefit of the basic policy1 if you are diagnosed with any of the 35 early, intermediate or severe-stage critical illnesses.

1Receive 12 additional monthly payouts if you are diagnosed with any of the 35 covered severe-stage critical illnesses.

1Receive additional payout if you are diagnosed with any of the 23 special conditions.

Advanced CI rider

Extra secure waiver

We will waive off the premiums of the basic policy up to age 86 or the end of the premium term of the policy, whichever is earlier, if you are diagnosed with any of the 37 covered severe-stage critical illnesses.

Extra disability care

Get advanced payout for death benefit of the basic policy1 in the event total and permanent disability is sustained before age 86.

Notes

1Please refer to the policy contract for full details of the terms and conditions.

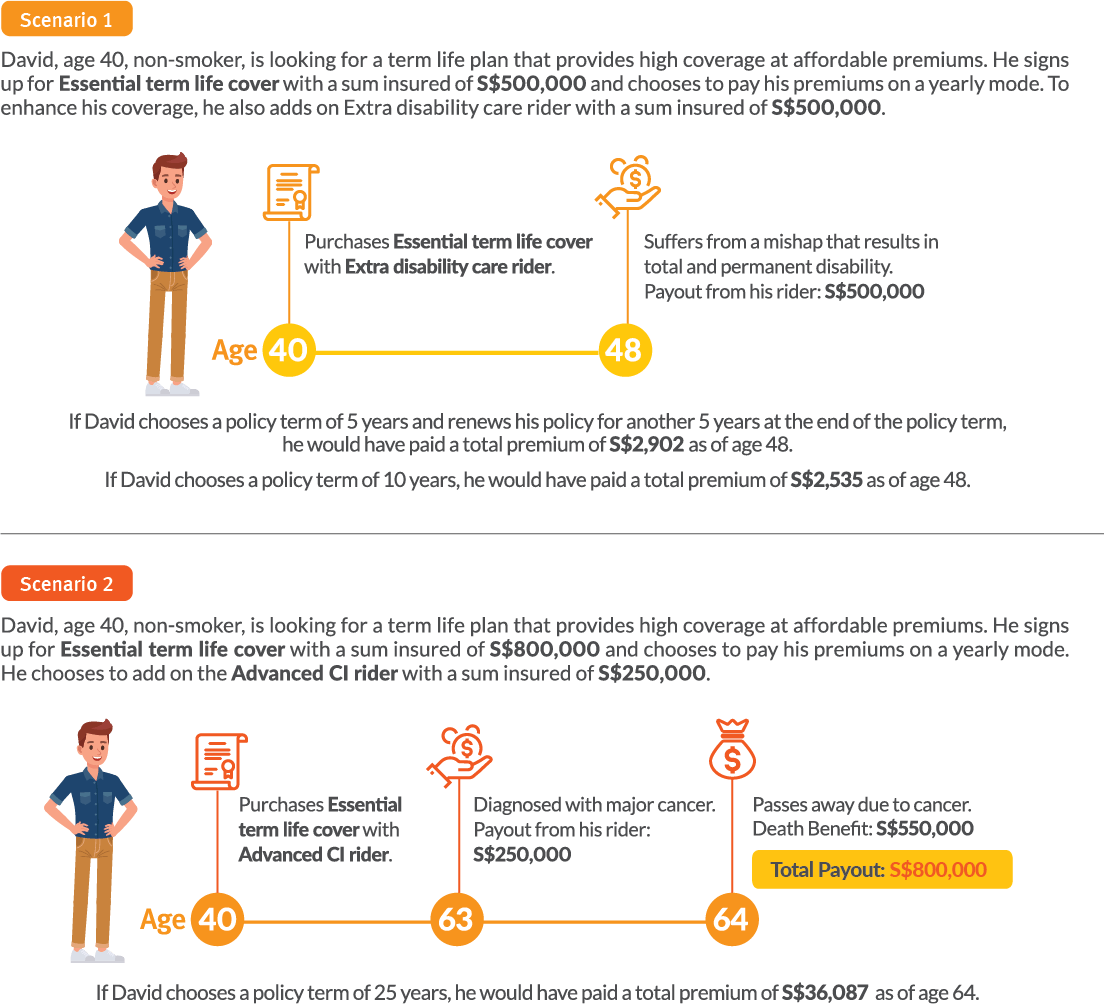

Here’s how Essential term life cover works

Download Brochures

Age means the age at the next birthday.

This policy is underwritten by Etiqa Insurance Pte. Ltd.. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

As this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information on this page is correct as of 30 November 2023.

You might also be interested in

Let us help you

Group

Group