Invest achiever

Product type

Policy term

Premium term

3, 5 or 10 years

What you can get

Receive multiple bonus payments

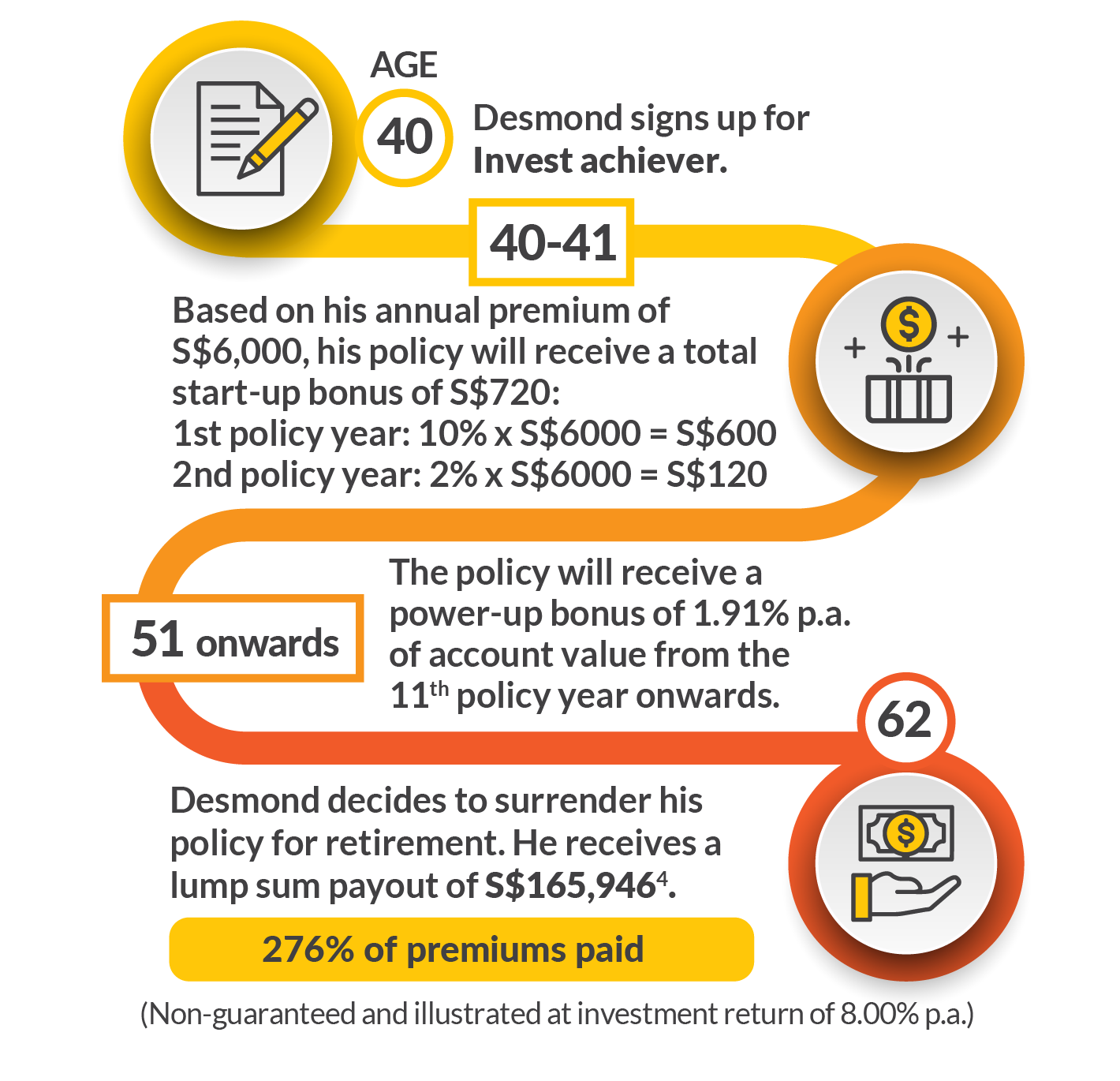

Enjoy a boost to your capital with the start-up bonus1 of up to 24% of your annual premium in the first two years of this plan. In addition, in return for your loyalty, you will receive a power-up bonus1 of 1.91% p.a. of account value from the 11th policy year onwards.

Switch funds at no charge

Enjoy the flexibility to switch to a better-performing fund at any time without any charge2.

Exclusive access to reputable funds

Ensure that your money works hard for you by relying on the expertise of professional managers. You can access funds managed by reputable regional and global asset management companies.

Death and total & permanent disability coverage

Worried about the unexpected? You or your loved ones will receive a lump sum payout equivalent to 105% of net premiums3 or account value less any outstanding amounts, whichever is higher, if total & permanent disability (up to age 65) or death happens.

Monthly cash payouts

Treat this as your retirement plan with the option to receive a monthly income¹ after the selected premium payment term.

No health check-up

Flexibility to tailor the plan

When a covered life contingency event4 occurs, you can choose to:

- Make partial withdrawals at no charge1 up to 15% of account value

- Take a break from paying premiums1 up to 12 months

Enhance your protection with this add-on

Accelerated Death and Total & Permanent Disability rider

With this add-on, we’ll take care of the balance of the rider sum insured upon death, giving you peace of mind should the unexpected happens.

If the Life insured becomes totally and permanently disabled before reaching the policy anniversary when he attains age 65, the death benefit payment will be accelerated.

Notes

1Subject to applicable terms and conditions. Please refer to the policy contract for more information.

2We reserve the right to revise the fund switch charges (if applicable) by giving thirty (30) days’ written notice.

3Net premium refers to total premium paid plus total top-up(s) less any partial withdrawal(s) and monthly income payout.

4Life Contingency Benefit is available after twenty-four (24) months from the policy commencement date, while the policy is inforce. This benefit can only be exercised once per policy.

Etiqa’s ILP Sub-Funds

ILP Sub-Funds

- Abrdn All China Sustainable Equity Fund

- Alliance Bernstein American Income Portfolio Fund

- Allianz Income and Growth Fund

- BlackRock Global Funds (“BGF”) European Equity Income Fund

- BlackRock Global Funds (“BGF”) ESG Multi-Asset Fund

- BlackRock Global Funds (“BGF”) World Technology Fund

- Capital Group American Balanced Fund

- Eastspring Japan Dynamic Fund

- First Sentier Bridge Fund

- FSSA Dividend Advantage Fund

- FSSA Regional China Fund

- Fullerton Asia Absolute Alpha Fund

- Fullerton SGD Income Fund

- LionGlobal Singapore Trust Fund

- Maybank Asian Equity Fund

- Maybank Asian Growth and Income Fund

- Maybank Asian Growth and Income-I

- Maybank Asian Growth and Income (DIST)

- Maybank Asian Growth and Income-I (DIST)

- Maybank Asian Income Fund

- MAMG Global Sukuk Income-I

- PIMCO Income Fund

- PineBridge International Funds – Singapore Bond Fund

- United Global Healthcare Fund

- United SGD Money Market Fund

- United Singapore Bond Fund

Etiqa’s ILP Sub-Funds

Here’s how Invest achiever works

Policy fees and charges apply. Please refer to the policy contract for full details of the terms and conditions.

5The scenario above is for illustration purposes only. The above illustrated values are based on illustrated investment rate of return of 8% per annum. Should the illustrated investment rate of return be 4% per annum, the illustrated policy value would be S$122,543 at age 62. The two rates, 4% per annum and 8% per annum, are used purely for illustrative purposes only, are non-guaranteed and do not represent the upper and lower limits on the investment performance of the selected funds. The actual benefits payable will vary according to the future performance of the selected funds. Past performance or any forecasts are not necessarily indicative of the future or likely performance of your selected funds.

Download Brochures

Age means the age at next birthday.

This policy is underwritten by Etiqa Insurance Pte. Ltd.. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

Invest achiever is an Investment-linked Plan (ILP) which invests in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s).

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from us via https://www.etiqa.com.sg/portfolio-funds-and-ilp-sub-funds. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 29 August 2024.

You might also be interested in

Let us help you