Invest plus SP

Product type

Investment-Linked Plan (ILP)

Policy term

Premium term

Single premium

What you can get

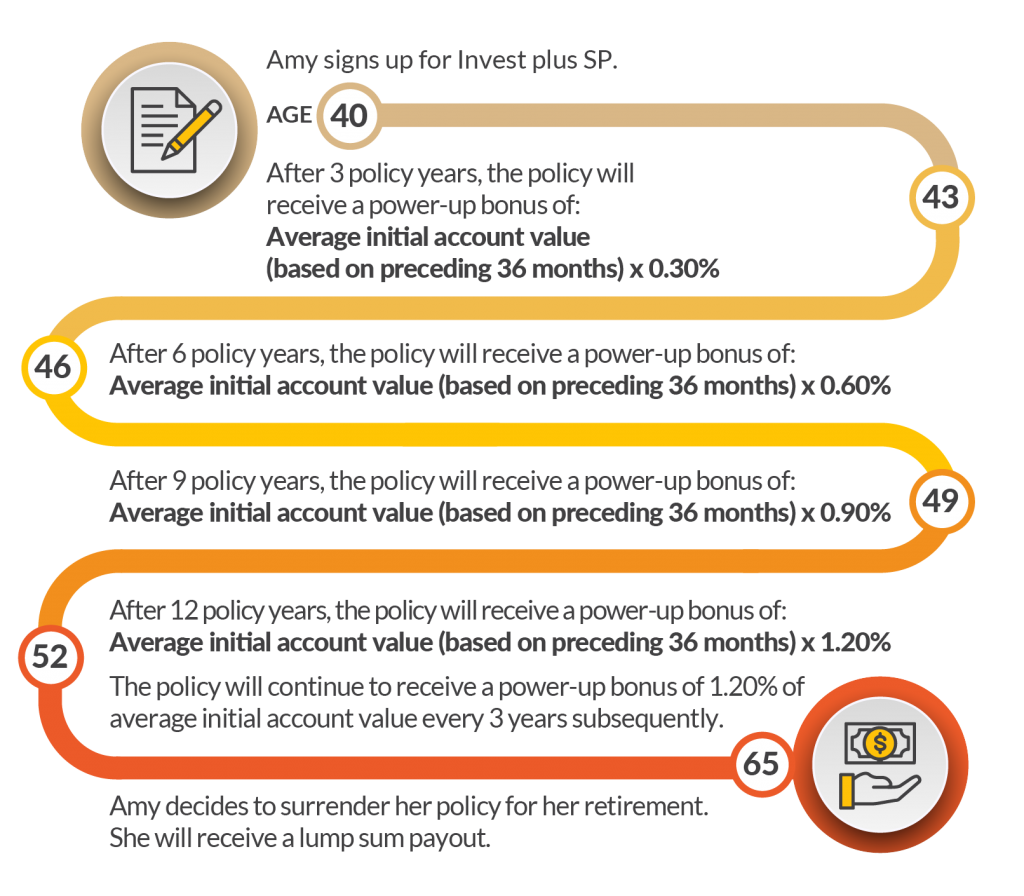

Power-up bonuses to boost your investment

No health check-up

Access to exclusive reputable funds

Flexibility to change Life insured1

Switch funds at no charge

Enjoy the flexibility to switch portfolio funds and ILP sub-funds at any time without charges3.

Death coverage

Be covered against death at the higher of 101% of net premiums4 or account value less any outstanding amounts.

Notes

1Subject to applicable terms and conditions. Please refer to the policy contract for terms and conditions.

2Payout date refers to every 3 completed years from the policy commencement date and each top-up effective date (if applicable).

3We reserve the right to revise the fund switch charges (if applicable) by giving thirty (30) days’ written notice.

4Net premium refers to total premium paid plus total top-up(s) less any partial withdrawal(s).

Etiqa’s Portfolio Funds and ILP Sub-Funds

We understand that everyone has a different approach to investing. We tailor your investment plan by matching your risk level and financial goals with these Portfolio funds, and a mixture of different ILP sub-funds.

Portfolio Funds

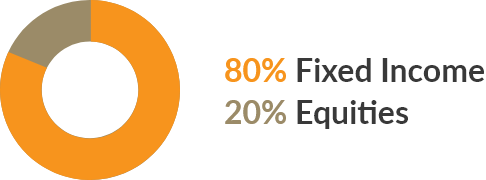

Conservative

Low Risk

Friendly for:

- Low risk taker

- Looking for stable returns

- Tolerance for low volatility

Moderate

Medium Risk

Friendly for:

- Medium risk taker

- Looking for moderate returns

- Tolerance for some unpredictable fluctuations

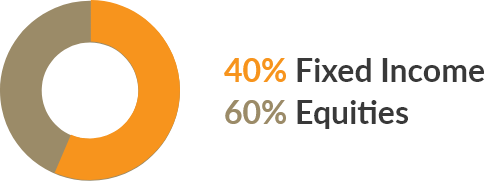

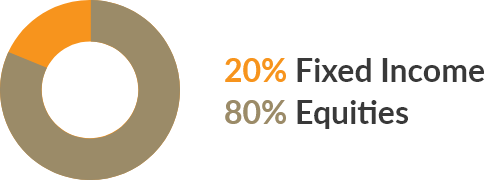

Growth

High Risk

Friendly for:

- High risk taker

- Looking for capital growth

- Tolerance for sharp fluctuations

Aggressive

High Risk

Friendly for:

- Higher risk taker

- Looking for maximum long term growth

- High tolerance for fluctuations

ILP Sub-Funds

- Alliance Bernstein American Income Portfolio Fund

- Abrdn All China Sustainable Equity Fund

- Abrdn Global Dynamic Dividend Fund

- Allianz Income and Growth Fund

- Baillie Gifford Worldwide Asia ex Japan Fund

- Baillie Gifford Worldwide Health Innovation Fund

- Baillie Gifford Worldwide Long Term Global Growth Fund

- BlackRock Global Funds (“BGF”) ESG Global Bond Income Fund

- BlackRock Global Funds (“BGF”) European Equity Income Fund

- BlackRock Global Funds (“BGF”) ESG Multi-Asset Fund

- BlackRock Global Funds (“BGF”) World Technology Fund

- Capital Group American Balanced Fund

- Eastspring Japan Dynamic Fund

- Finexis Millenium Equity Fund

- First Sentier Bridge Fund

- FSSA Dividend Advantage Fund

- FSSA Regional China Fund

- Fullerton Asia Absolute Alpha Fund

- Fullerton SGD Income Fund

- Fundsmith Equity Fund

- LionGlobal Infinity Global Stock Index Fund

- LionGlobal Singapore Dividend Equity Fund

- LionGlobal Singapore Trust Fund

- Maybank Asian Equity Fund

- Maybank Asian Growth and Income Fund

- Maybank Asian Growth and Income-I

- Maybank Asian Growth and Income (DIST)

- Maybank Asian Growth and Income-I (DIST)

- Maybank Asian Income Fund

- MAMG Global Sukuk Income-I

- Nikko AM ARK Disruptive Innovation Fund

- Pictet Premium Brands Fund

- PIMCO Income Fund

- PineBridge International Funds – Singapore Bond Fund

- SCHRODER AS COMMODITY A ACC SGD-H

- United Global Healthcare Fund

- United SGD Money Market Fund

- United Singapore Bond Fund

Here's how Invest plus SP works

Download Brochures

Age means the age at next birthday.

This policy is underwritten by Etiqa Insurance Pte. Ltd.. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

Invest plus SP is an Investment-linked Plan (ILP) which invests in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s).

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from us via https://www.etiqa.com.sg/portfolio-funds-and-ilp-sub-funds. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 28 March 2024.

You might also be interested in

Let us help you

Group

Group