Invest starter

Invest starter is a regular premium investment-linked plan with entry premiums from as low as S$100 a month and low charges that allows anyone to start investing and maximise their returns while getting covered for life’s uncertainties throughout the policy term.

Product type

Policy term

Premium term

Regular premium

What you can get

Multiple rewards to boost your investment

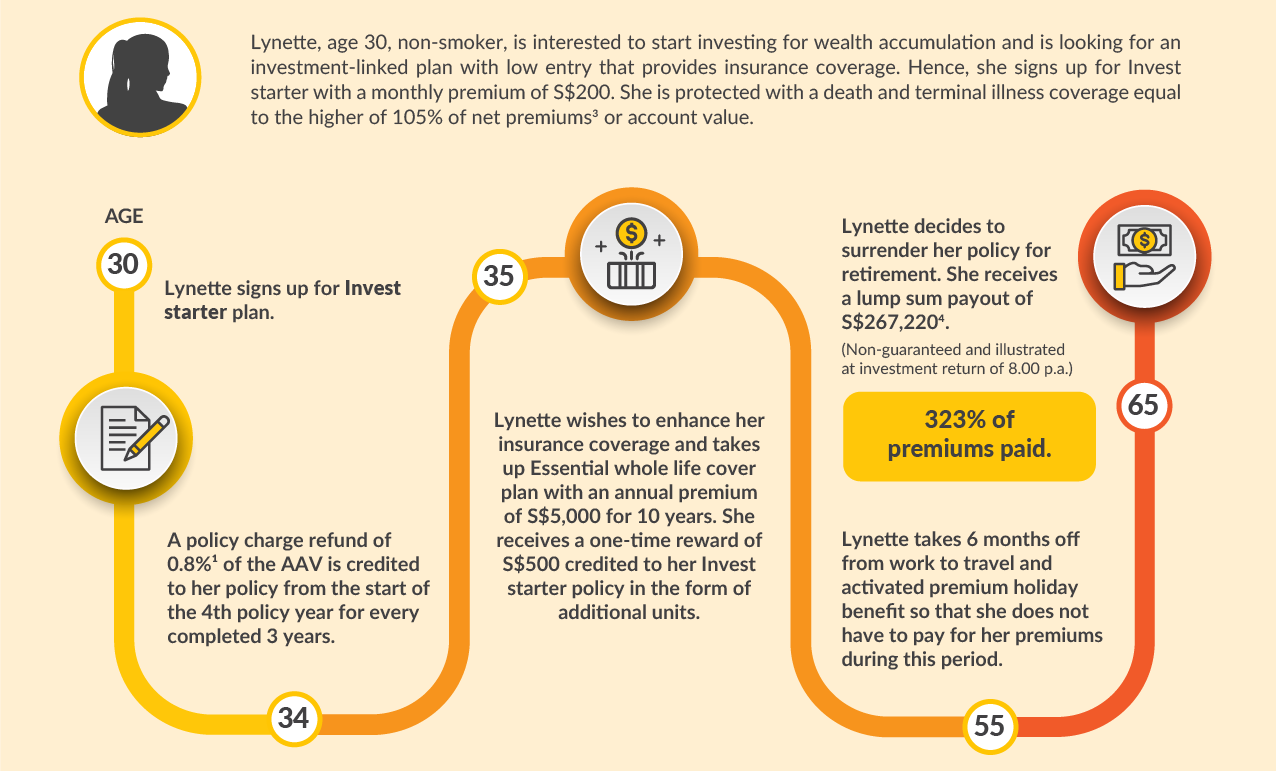

• A policy charge refund of 0.8%1 of the Average Account Value (AAV) will be credited to your policy from the start of the 4th policy year for every completed 3 years if no partial withdrawal is made.

• Purchase an additional eligible plan and get a one-time reward1 of up to 10% of first year annual premium of the new plan credited to your policy in the form of additional units.

| List of Eligible Plans | One-Time Reward |

|---|---|

| Invest builder and rider (if any) | 5% of the first year annual premium |

| ePROTECT mortgage and rider (if any) | 10% of the first year annual premium |

| Essential Cancer Care and rider (if any) | 10% of the first year annual premium |

| Essential whole life cover and rider (if any) | 10% of the first year annual premium |

| Essential term life cover and rider (if any) | 5% of the first year annual premium |

| Essential critical secure and rider (if any) | 10% of the first year annual premium |

Access to portfolio funds with diversified risks

From as low as S$100 a month.

Hassle-free application

Guaranteed issuance policy; no health checks needed for Invest starter plan.

Protection

Enhance your coverage with optional rider(s) subject to underwriting:

- Advanced CI rider

Accelerate the death coverage payout of the basic plan upon diagnosis of any of the 36 covered severe-stage critical illnesses. - Extra disability care rider

Accelerate the death coverage payout of the basic plan for total & permanent disability (before age 86).

Flexibility to meet your needs

- Option to do adhoc top-ups1 and increase the regular premium amount1 at any time.

- Option to request for a reduction of the regular premium amount1 or partial withdrawals1 or activate premium holiday1 from the 6th policy year at no charge when you need it.

- Option to change the Life insured1 at any time from the 3rd policy year onwards.

- Option to switch portfolio fund at any time without charges2.

Notes

1Subject to applicable terms and conditions. Please refer to the policy contract for more information.

2We reserve the right to revise the fund switch charges (if applicable) by giving thirty (30) days’ written notice.

3Net premium refers to total premium paid plus total top-up(s) less any partial withdrawal(s) and monthly income payout.

Portfolio Funds

We’ve curated these Portfolio funds to match your risk level with a mixture of different ILP sub-funds.

Portfolio Funds

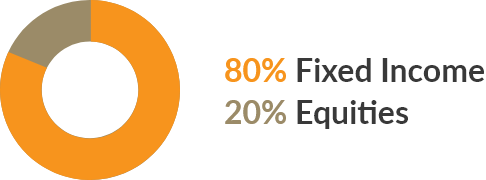

Conservative

Low Risk

Friendly for:

- Low risk taker

- Looking for stable returns

- Tolerance for low volatility

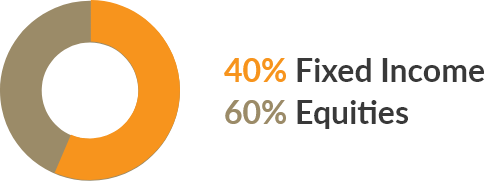

Moderate

Medium Risk

Friendly for:

- Medium risk taker

- Looking for moderate returns

- Tolerance for some unpredictable fluctuations

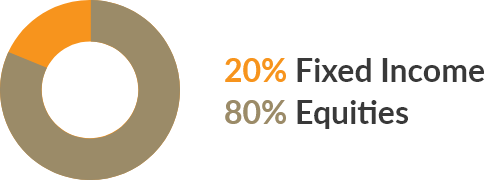

Growth

High Risk

Friendly for:

- High risk taker

- Looking for capital growth

- Tolerance for sharp fluctuations

Aggressive

High Risk

Friendly for:

- Higher risk taker

- Looking for maximum long term growth

- High tolerance for fluctuations

Here’s how Invest starter works

Policy fees and charges apply. Please refer to the policy contract for full details of the terms and conditions.

4The scenario above is for illustration purposes only. The above illustrated values are based on illustrated investment rate of return of 8% per annum. Should the illustrated investment rate of return be 4% per annum, the illustrated policy value would be S$117,764 at age 65. The two rates, 4% per annum and 8% per annum, are used purely for illustrative purposes only, are non-guaranteed and do not represent the upper and lower limits on the investment performance of the selected funds. The actual benefits payable will vary according to the future performance of the selected funds. Past performance or any forecasts are not necessarily indicative of the future or likely performance of your selected funds.

Download Brochures

Age means the age at next birthday.

This policy is underwritten by Etiqa Insurance Pte. Ltd., a member of Maybank Group.

Invest starter is an Investment-linked Plan (ILP) which invests in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s).

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from us via https://www.etiqa.com.sg/portfolio-funds-and-ilp-sub-funds. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 25 July 2024.

Let us help you

Group

Group